Texas is stepping into the future with its new plan to use public treasury funds for Bitcoin purchases. By proposing Senate Bill 778, the state aims to diversify its assets and enhance financial stability. This initiative, backed by key political figures, raises questions about the long-term impacts on Texas's economy and its role in the cryptocurrency landscape. What could this mean for other states considering similar moves?

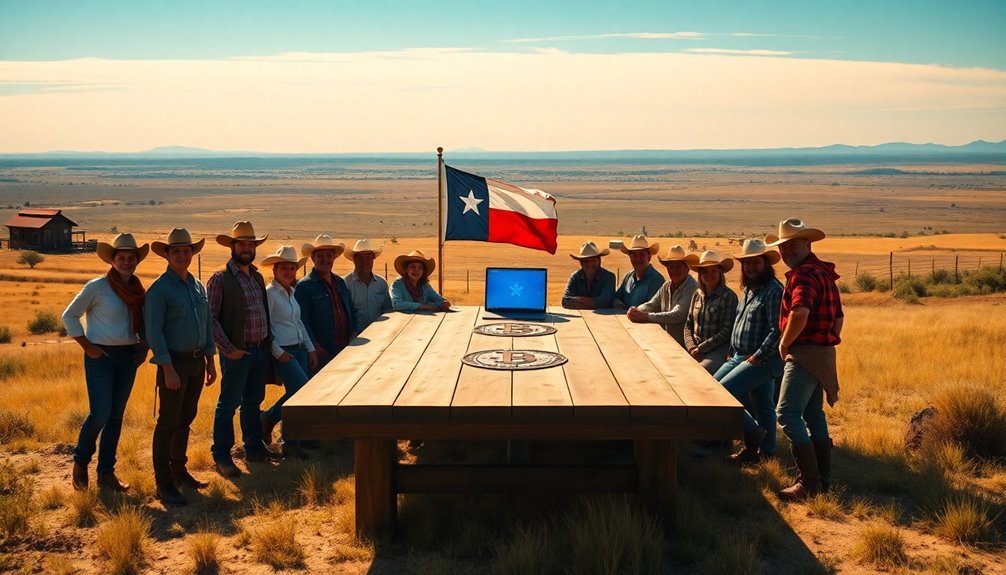

Texas is boldly stepping into the future of finance by pioneering Bitcoin adoption through innovative legislative measures. With the introduction of Senate Bill 778, the state aims to allocate up to 1% of its general revenue for Bitcoin purchases. This initiative is part of a broader economic strategy designed to diversify state assets and safeguard public finances from economic fluctuations.

By embracing cryptocurrency, Texas isn't just enhancing its financial portfolio; it's positioning itself as a leading hub for blockchain technology and cryptocurrency innovation. The state's expanding mining infrastructure is a testament to its commitment to becoming a major player in the digital economy.

Texas is not only diversifying its finances but also establishing itself as a forefront leader in blockchain and cryptocurrency innovation.

You might be intrigued by how Texas plans to make Bitcoin a strategic asset. The proposed legislation views Bitcoin as a reliable store of value, which could reduce the state's reliance on traditional assets like gold and fiat currencies. One of the most compelling aspects is the commitment to hold these Bitcoin assets for a minimum of five years, fostering long-term financial stability.

With the removal of the $500 million annual cap on acquisitions, Texas is enhancing market flexibility, allowing for more aggressive engagement with this digital asset.

The legislative agenda under Lieutenant Governor Dan Patrick prioritizes this Bitcoin reserve proposal, underscoring its importance for the state's financial future. Senator Charles Schwertner's bill has garnered significant support, indicating broad political will to transform Texas into a leader in the digital economy.

If successful, Texas would become the first state to establish a Strategic Bitcoin Reserve, potentially setting a national precedent for others to follow. This proactive approach illustrates how states are advancing in the cryptocurrency space, often outpacing federal initiatives.

The economic benefits of this initiative are substantial. Bitcoin mining operations are creating jobs and contributing to local economies, while increased tax revenues from these activities bolster public services, including education.

By integrating Bitcoin into its financial system, Texas could further stimulate economic growth and enhance its autonomy in fiscal management. Proponents argue that Bitcoin's decentralized nature offers a reliable counterbalance against traditional financial risks.

Moreover, Texas is exploring various blockchain technologies beyond Bitcoin, creating an innovation-friendly environment that attracts entrepreneurs and developers in the crypto sector.

Upgrading the state's energy infrastructure further supports this burgeoning industry, ensuring that Texas remains competitive in the rapidly evolving landscape of cryptocurrency.