Investing in a Gold IRA in Delaware allows you to capitalize on special opportunities and beneficial local regulations. Gold investments need to meet the IRS purity standard of 99.5% and should be stored in approved depositories to ensure compliance. Delaware does not have a state sales tax, which helps lower your expenses, and robust asset protection laws protect your investments. By allocating 5-15% of your portfolio to gold, you can effectively diversify and mitigate risks. As you investigate your options, you will gain further understanding on how to maximize the potential of your Gold IRA in Delaware.

Key Takeaways

- Gold IRAs in Delaware allow investment in physical gold, with a minimum purity requirement of 99.5% for eligible metals.

- Delaware offers tax advantages, such as no state sales tax and strong asset protection for Gold IRA investments.

- Secure storage of precious metals must be in IRS-approved depositories, with options like Delaware Depository available for compliance.

- Self-directed IRAs provide flexibility, allowing control over diverse investments beyond traditional assets, with funding through rollovers or direct contributions.

- Initial setup and maintenance costs for a Gold IRA typically range from $350 to $450, plus annual storage fees.

Overview of Gold IRAs

When considering retirement investments, a Gold IRA can be a smart choice for diversifying your portfolio. This self-directed retirement account allows you to invest in physical gold and other approved precious metals, all while staying compliant with IRS regulations.

To qualify, the gold you invest in must meet a minimum purity requirement of 99.5%. Eligible options include well-known coins like American Gold Eagles and Canadian Maple Leafs. Additionally, the potential for higher returns with gold as a long-term investment makes it an appealing option for many investors.

Gold IRAs offer significant tax advantages, such as tax-deferred growth. This means your investments can appreciate without incurring immediate tax liability until you make a withdrawal.

However, unlike traditional IRAs, you'll need to store your physical gold in IRS-approved third-party depositories, such as the Delaware Depository, to guarantee both security and compliance.

Establishing a Gold IRA involves selecting a custodian who specializes in precious metals, completing the necessary IRS paperwork, and being aware of the associated fees and regulations.

Benefits of Gold IRA Investing

Investing in a Gold IRA offers you effective wealth preservation strategies, especially during economic uncertainty.

By incorporating gold into your portfolio, you can enhance diversification and better manage risk. This approach not only stabilizes your investments but may also improve your overall returns.

Many investors have turned to trusted precious metal investments to secure their financial future, taking advantage of the unique benefits that gold can provide.

Wealth Preservation Strategies

Gold IRAs serve as a powerful wealth preservation strategy, allowing you to invest in physical gold that tends to maintain its value during economic downturns and inflationary periods. By including gold in your retirement portfolio, you can create a hedge against the unpredictable economic landscape.

Historically, gold outperforms stocks during market volatility, which means your investments can remain stable when traditional markets decline.

The Taxpayer Relief Act of 1997 permits the inclusion of gold and other precious metals in self-directed IRAs, enabling tax-deferred growth until withdrawal. This feature enhances your long-term financial security.

A recommended allocation of 5-10% in gold within your IRA can provide a buffer against market fluctuations, offering protection as you approach retirement. For those looking to maximize returns, conservative portfolios with a 25% allocation to gold have shown improved performance over decades.

Ultimately, gold investments not only preserve wealth but can also enhance your overall portfolio performance. By diversifying with gold, you can safeguard your assets against currency devaluation and guarantee a more resilient retirement plan through the uncertainties of the economic landscape.

Diversification and Risk Management

Diversification is essential for effective risk management in your retirement portfolio, and incorporating a Gold IRA can greatly enhance this strategy. By adding physical gold to your retirement funds, you not only stabilize your investments but also hedge against market volatility.

Historical data shows that including gold in your IRA investments can improve average annualized growth rates. Additionally, Gold IRAs are governed by IRS regulations that guarantee the integrity and quality of the assets, providing peace of mind for investors.

Consider these benefits of diversifying with a Gold IRA:

- Reduced Volatility: Gold historically maintains its value better than paper assets during economic downturns.

- Inflation Hedge: Precious metals like gold act as a safeguard against inflation and currency devaluation.

- Tax Advantages: Gold IRAs allow for tax-deferred growth, contributing to long-term wealth preservation.

Financial experts suggest allocating 5% to 15% of your retirement portfolio to precious metals. This strategy not only helps you diversify your retirement portfolio but also enhances your protection against unpredictable market fluctuations.

Delaware's Regulatory Landscape

When you consider investing in a Gold IRA in Delaware, it's essential to understand the state-specific regulations that govern eligible assets, including the strict purity requirements.

Delaware also offers some enticing tax advantages that can benefit your overall investment strategy.

Knowing these details can help you make informed decisions as you navigate the Gold IRA landscape.

State-Specific Regulations Overview

In Delaware, understanding the specific regulations governing Gold IRAs is vital for investors aiming to maximize their retirement savings.

First and foremost, you'll need to guarantee that your gold investments meet the IRS purity standards of at least 99.5%. This requirement is critical for your investments to qualify for tax-advantaged status.

Additionally, Delaware permits Gold IRAs to be held in approved depositories, like the Delaware Depository. This arrangement not only enhances the security of your retirement assets but also guarantees compliance with federal regulations for asset storage.

To navigate the regulatory landscape effectively, keep these key points in mind:

- Guarantee your gold meets the IRS purity standards.

- Use approved depositories to store your Gold IRA investments securely.

- Work with IRS-approved custodians to manage your retirement assets properly.

Tax Advantages in Delaware

Investing in a Gold IRA in Delaware comes with significant tax advantages that can enhance your overall returns. One of the most appealing aspects is the absence of state sales tax, which lowers the cost of purchasing precious metals for your gold IRA. This means you can invest more in your retirement without worrying about additional taxes eating into your capital.

Delaware also offers a favorable regulatory environment for self-directed IRAs, allowing you a broader range of investment options, including physical gold and other precious metals. This flexibility can help you create a diversified portfolio tailored to your financial goals.

Moreover, Delaware law provides strong asset protection measures, ensuring your Gold IRA assets are safeguarded from creditors. This security is vital for peace of mind as you prepare for retirement.

Investment Opportunities in Delaware

Delaware offers a wealth of investment opportunities that can greatly enhance your portfolio. With its favorable legal environment and tax advantages, you can explore various avenues within a gold IRA. The state's no sales tax policy makes it particularly appealing for real estate investments and asset holdings in your self-directed IRA.

Consider these investment opportunities in Delaware:

- Beachfront properties: Ideal for both personal enjoyment and rental income.

- Historic townhouses: These can provide steady returns and contribute to portfolio diversification.

- Private businesses: With over 60% of Fortune 500 companies incorporated here, investing in local businesses can yield significant benefits.

Additionally, the Delaware Depository provides secure, IRS-approved storage for your precious metals, ensuring compliance and peace of mind.

This combination of investment options and robust infrastructure allows you to innovate your retirement strategy effectively. By leveraging Delaware's unique offerings, you can make informed decisions about your gold IRA, ultimately optimizing your financial future.

Embracing these opportunities can lead to a well-rounded and resilient investment portfolio tailored to your goals.

Establishing a Self-Directed IRA

A Self-Directed IRA (SDIRA) gives you the power to take charge of your retirement investments, allowing for a diverse range of options beyond traditional assets. If you're considering a self-directed Gold IRA, the process is straightforward.

First, you'll need to open a Gold IRA account through a custodian like Madison Trust. You'll then fund your new account, either by rolling over funds from an existing retirement account or making direct contributions. This flexibility and control is particularly advantageous in today's economic landscape where investment strategies in precious metals are becoming increasingly popular.

Once your account is set up, you can begin investing in alternative assets such as precious metals, real estate, or private businesses.

Delaware's favorable regulations enhance your experience, making it easier to manage your investments. For even greater control, consider establishing an IRA LLC, which allows you to navigate daily transactions through a checkbook IRA structure.

Don't forget about IRA storage; it's essential to store your gold and other precious metals in an IRS-approved facility. This guarantees your investments remain compliant while enjoying tax-advantaged growth.

With your self-directed Gold IRA, you're equipped to align your investment strategy with your retirement goals, maximizing your future wealth.

Funding Your Gold IRA

Funding your Gold IRA is a key step in taking control of your retirement investments. You can fund your account through IRA Rollovers from existing retirement accounts or direct contributions. If you opt for a rollover, be mindful of the 60-day rule to avoid potential penalties. Transfers between IRAs are often simpler since they aren't taxable and bypass the 60-day requirement.

Here are some important considerations for funding your Gold IRA:

- Confirm that the gold you purchase meets IRS purity requirements of at least 99.5%.

- The minimum investment amount for establishing a Gold IRA typically starts around $5,000, depending on your custodian.

- Be aware of administrative costs, like setup and annual maintenance fees, which usually range from $350 to $450.

Careful planning is essential when funding your Gold IRA, as these factors can impact your overall investment strategy.

Make sure you choose a custodian that aligns with your goals and provides transparent information about any fees involved. With the right approach, you can effectively build a robust retirement portfolio centered around precious metals.

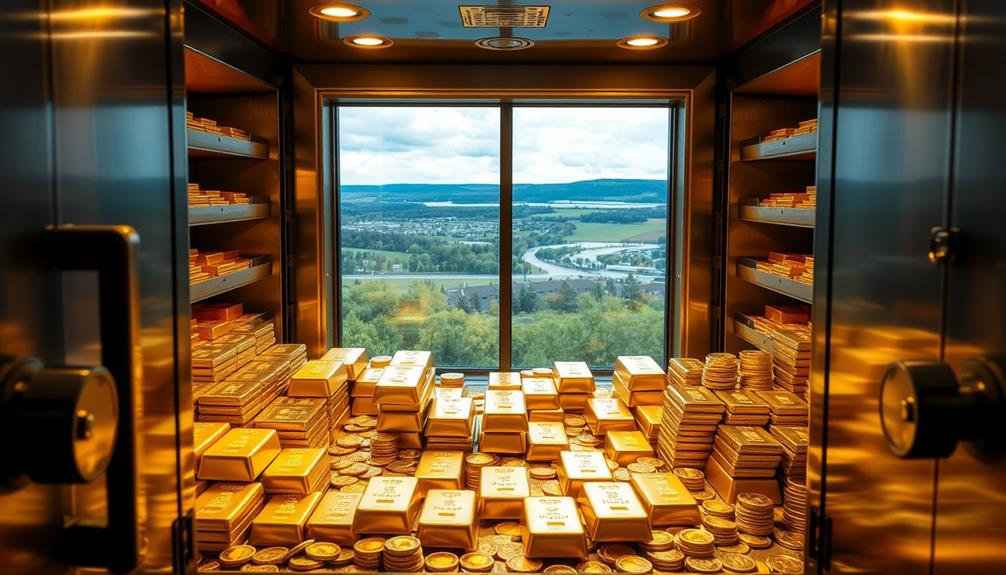

Storage Solutions for Precious Metals

When investing in a Gold IRA, understanding your storage options is essential for compliance and security. In Delaware, the IRS mandates that your precious metals must be stored in IRS-approved third-party depositories. This means you can't keep your gold IRA assets at home, ensuring they're protected and compliant with federal regulations.

One highly regarded option is the Delaware Depository, known for its advanced security measures and insurance coverage. While you'll receive certificates of ownership for your gold IRA assets, you won't have physical access to the metals, as they must remain in the depository. This arrangement provides peace of mind, knowing your investment is secure.

When considering costs, be prepared for storage fees, which typically range from $200 to $400 annually. These fees may vary based on the depository you choose and the amount of precious metals stored.

Additionally, recent regulatory changes have opened up options for offshore storage, allowing you to decide between domestic and international depositories for your gold IRA. This flexibility can be beneficial as you tailor your investment strategy to meet your needs and preferences.

Pros and Cons of Gold IRAs

Investing in a Gold IRA comes with both advantages and drawbacks that you should carefully consider. Understanding the gold IRA pros and IRA pros and cons can help you make an informed decision to protect your retirement savings.

Pros:

- Gold provides a hedge against inflation and currency devaluation, offering stability during economic downturns.

- Investing in gold allows for diversification, reducing your dependence on the stock market.

- Historical performance suggests gold can enhance portfolio returns during market volatility, with experts recommending a 5% to 15% allocation.

Cons:

- Higher fees associated with Gold IRAs, like storage and management costs, can diminish your overall returns compared to traditional IRAs.

- Physical gold doesn't generate interest or dividends, which may limit your income generation during the investment period.

Getting Started With Gold IRA

Initiating the journey of establishing a Gold IRA can be both exciting and intimidating. To get started, you'll first need to select an IRS-approved custodian specializing in precious metals. This custodian will help facilitate the account setup and guarantee compliance with all regulations.

The process typically involves completing necessary IRS paperwork and rolling over funds from your existing retirement accounts. If you manage this properly, you can often do it without incurring taxes.

When it comes to eligible gold, remember that it must meet a minimum purity requirement of 99.5%. Approved coins include American Gold Eagles and Canadian Maple Leafs.

Once you've chosen your custodian, you'll also need to examine secure storage options for your physical gold. The Delaware Depository is a reliable choice, as it ensures compliance with IRS regulations prohibiting personal storage of IRA-held precious metals.

Keep in mind that initial setup and annual maintenance fees for a Gold IRA in Delaware can range from $350 to $450, plus additional costs for insurance and storage.

Frequently Asked Questions

Is Investing in Gold IRA a Good Idea?

Investing in a Gold IRA can be a smart move for you. It offers a hedge against inflation and market volatility, allowing your retirement portfolio to diversify and potentially grow without immediate tax implications.

How Can I Open a Gold Ira?

Imagine you want to secure your retirement. To open a Gold IRA, choose an IRS-approved custodian, complete the required paperwork, and fund it via rollovers or cash contributions to start investing in precious metals.

Where Can I Store My Gold Ira?

You can store your Gold IRA at IRS-approved depositories, ensuring your assets are secure and compliant. Look for facilities with strong security measures, reasonable fees, and easy accessibility to protect your investment effectively.

What Is the Minimum Investment for a Gold Ira?

"Don't put all your eggs in one basket." To start a Gold IRA, you'll typically need at least $5,000 to $10,000. Always check with your custodian for specific requirements and potential additional costs.

Conclusion

In the grand scheme of investing, a Gold IRA in Delaware isn't just a smart choice—it's like finding a pot of gold at the end of a rainbow! With its favorable regulations and countless opportunities, you could be on the path to financial freedom faster than you can say "precious metals." So, don't just sit there—seize this golden opportunity and transform your retirement dreams into a dazzling reality! Your future self will thank you!

Helen brings a wealth of experience in investment strategy and a deep passion for helping individuals achieve their retirement goals. With a keen understanding of market dynamics, Helen has been instrumental in shaping the vision and direction of Gold IRA Markets. She specializes in creating innovative solutions that align with our clients’ long-term investment objectives.