Were you aware that gold has been regarded as a valuable asset for centuries, prized for its ability to safeguard wealth and serve as a buffer against economic uncertainties?

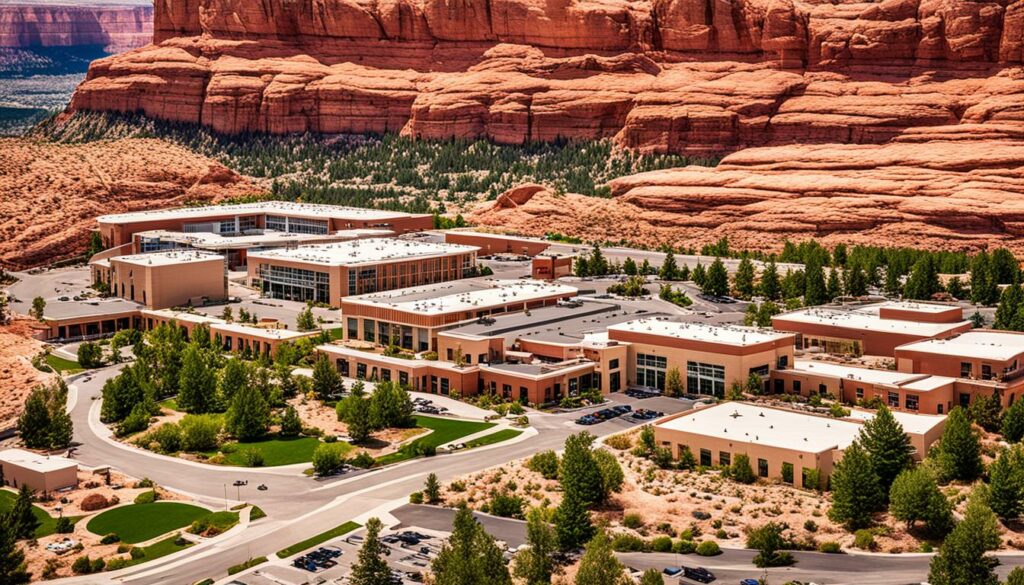

When it comes to investing in gold, it is essential to choose a trustworthy and reputable company that can guide you through the process of acquiring and safeguarding precious metals for your retirement portfolio. One such company that has made waves in the industry is Red Rock Secured.

Red Rock Secured, formerly known as American Coin Co., has gained recognition as a leading provider of gold IRA services, offering a range of products and services to help investors diversify their retirement savings. However, recent investigations by the Securities and Exchange Commission (SEC) have raised concerns about the company’s current status and trustworthiness.

Before considering any investment decisions, it is crucial to examine the facts, evaluate the company’s history and services, and understand the implications of the SEC investigation. Let’s explore the details of Red Rock Secured and determine if it truly lives up to its reputation as a trusted gold investment option.

Key Takeaways:

- Gold is a valuable asset that can protect wealth and act as a hedge against economic uncertainties.

- Red Rock Secured is a company that offers gold IRA services, helping investors diversify their retirement savings.

- The SEC investigation has raised concerns about the company’s trustworthiness, urging investors to exercise caution before investing.

- Before making any investment decisions, it is crucial to conduct thorough due diligence and evaluate the company’s history and services.

- Stay informed on the latest updates regarding Red Rock Secured to make prudent choices in the precious metals investment space.

The History and Services of Red Rock Secured

For over a decade, Red Rock Secured has been a prominent name in the field of precious metals investing, particularly gold IRA. Founded by Sean Kelly in the aftermath of the 2008 financial crisis, the company offered a sense of stability and long-term wealth accumulation through retirement savings. With a commitment to client service and expertise in precious metals investing, Red Rock Secured gained industry recognition and respect.

Red Rock Secured understands the importance of retirement savings and the role of precious metals in diversifying investment portfolios. They offer a range of services tailored to meet their clients’ needs, including:

- Gold IRA: Red Rock Secured helps individuals protect and grow their retirement savings by setting up and managing gold IRA accounts. This allows investors to hold physical gold and other precious metals in a tax-advantaged retirement account.

- Investment Education: Red Rock Secured provides educational resources and guidance to empower individuals with the knowledge they need to make informed investment decisions. This includes information on the benefits of investing in precious metals, the process of setting up a gold IRA, and market insights.

- Bullion Sales: Red Rock Secured offers a variety of gold and silver bullion products for direct purchase. Clients can choose from a selection of coins and bars, ensuring they have access to high-quality, investment-grade metals.

- Portfolio Diversification: Red Rock Secured emphasizes the importance of diversification in creating a well-rounded investment portfolio. Alongside gold and silver, they also offer platinum and palladium options, allowing investors to tailor their portfolios to individual goals and risk tolerance.

It is important to consider the recent investigation by the SEC and the potential implications it may have on the company’s legitimacy and performance. Despite its history and expertise, investors are advised to exercise caution and conduct thorough due diligence before engaging with Red Rock Secured.

| Services | Features |

|---|---|

| Gold IRA | Tax-advantaged retirement account |

| Investment Education | Empowering clients with knowledge |

| Bullion Sales | Wide selection of gold and silver products |

| Portfolio Diversification | Access to platinum and palladium options |

Unique Selling Proposition of Red Rock Secured

Red Rock Secured stands out in the gold IRA industry with its unique offering, the Price Protection Plan. This innovative plan provides a safety net for gold IRA clients, compensating for losses in the event of a drop in the price of gold or silver within the first week of purchase.

This exclusive feature provides peace of mind to investors, ensuring that their hard-earned money is protected from sudden market fluctuations. With the Price Protection Plan, clients can confidently invest in precious metals, knowing that Red Rock Secured has their best interests at heart.

Furthermore, Red Rock Secured goes above and beyond to reward its gold IRA clients. The company offers enticing promotions such as free silver offers, allowing investors to diversify their portfolios without additional cost. In addition, Red Rock Secured provides VIP accounts for high net-worth individuals, delivering personalized service and exclusive benefits.

By focusing on customer service and transparency, Red Rock Secured cements its commitment to client satisfaction. The company understands the importance of building long-lasting relationships and ensuring that every investor feels valued and supported throughout their gold IRA journey.

Investor Testimonial:

“Red Rock Secured’s Price Protection Plan gave me the confidence to invest in gold IRA. Knowing that my investment is safeguarded against market volatility is a game-changer. The team’s dedication to customer satisfaction is evident, and I couldn’t be happier with my experience.”

Red Rock Secured’s unique selling proposition, along with its focus on customer service and transparency, makes it a compelling choice for individuals looking to safeguard their retirement savings through gold IRA investments.

| Unique Selling Points | Benefits |

|---|---|

| Price Protection Plan | Compensation for losses within the first week of purchase |

| Free Silver Offers | Opportunity to diversify investment without additional cost |

| VIP Accounts | Exclusive benefits and personalized service for high net-worth individuals |

Product Offerings and Selection

Red Rock Secured offers a wide range of physical gold and silver products to meet the diverse needs of investors. Their portfolio includes a variety of bullion bars and coins, providing options for both seasoned collectors and those new to the precious metals market.

Each metal held by Red Rock Secured meets investment-grade purity standards, ensuring that investors receive high-quality assets that retain their value over time.

The company’s selection of gold and silver products is designed to cater to different investment objectives, including portfolio diversification and potential market growth. For those looking to diversify their retirement savings, Red Rock Secured offers a range of IRA-eligible products.

Here is an overview of the product offerings available through Red Rock Secured:

- Bullion Bars: Red Rock Secured provides a variety of bullion bars in different sizes, allowing investors to choose the option that best suits their investment goals and budget.

- Coins: The company offers a wide selection of gold and silver coins, including popular choices such as American Eagles, Canadian Maple Leafs, and South African Krugerrands.

- Silver Offerings: Red Rock Secured recognizes the potential for growth in the silver market and provides investors with opportunities to leverage this potential through silver products.

- Premium Metals: In addition to gold and silver, Red Rock Secured offers platinum and palladium options for investors seeking to diversify their portfolios beyond traditional precious metals.

By offering a diverse range of physical gold and silver products, Red Rock Secured aims to provide investors with the tools they need to build a well-rounded and resilient investment portfolio.

Fee Structure and Comparison

When considering a Gold IRA, evaluating the fee structure is paramount. Red Rock Secured, a leading name in the industry, offers fee waivers for qualified clients, eliminating fees associated with gold IRA accounts. However, it’s important to note that the company does not readily disclose its pricing information online. Potential investors are encouraged to contact the customer service team for detailed fee disclosures.

Comparing Red Rock Secured’s fee structure with industry standards can help make an informed decision about ongoing expenses tied to retirement investments. Ensuring transparency and aligning with industry norms is crucial for building trust and confidence in the gold IRA sector.

Understanding the Gold IRA Fee Structure

To assess the fees associated with a Gold IRA, it’s essential to understand the key components typically involved in a fee structure:

- Administrative fees

- Custodial fees

- Transaction fees

- Storage fees

By comparing red Rock Secured’s fee structure with industry standards, investors can gain insights into the competitiveness and fairness of their pricing model.

Red Rock Secured’s Unique Fee Structure

Red Rock Secured sets itself apart by offering fee waivers for qualified clients. This unique feature eliminates certain fees associated with gold IRA accounts and can potentially reduce investors’ overall expenses.

“Red Rock Secured’s fee waivers for qualified clients provide a notable advantage in the gold IRA market.”

However, it’s important to consider that detailed fee information is not publicly available online. Contacting the customer service team directly is necessary to obtain specific fee disclosures tailored to individual investment needs.

Industry Standards for Gold IRA Fees

When evaluating Gold IRA fees, it’s beneficial to compare Red Rock Secured’s pricing structure to industry standards. This allows investors to gauge the reasonableness and competitiveness of fees, ensuring they are not paying more than necessary.

| Fee Category | Red Rock Secured | Industry Standard |

|---|---|---|

| Administrative fees | N/A* | Varies by provider |

| Custodial fees | N/A* | Typically 0.25%—0.5% annually |

| Transaction fees | N/A* | Varies by provider |

| Storage fees | N/A* | Varies by provider and asset type |

*Contact Red Rock Secured’s customer service for detailed fee disclosures.

While Red Rock Secured’s fee structure may differ from industry standards due to the fee waivers for qualified clients, it’s essential to consider the overall fairness and competitiveness of the pricing model when making investment decisions.

Custody and Storage Solutions

Red Rock Secured understands the importance of safeguarding client investments and provides comprehensive custody and storage solutions to ensure the security of precious metals assets.

Partnering with Lloyd’s of London, a leading insurance marketplace, Red Rock Secured offers clients peace of mind through comprehensive insurance coverage for their storage facilities. This partnership ensures that client investments are protected against any unforeseen circumstances.

The company’s secure storage solutions provide a safe and reliable environment for storing precious metals. With state-of-the-art facilities equipped with advanced security measures, Red Rock Secured prioritizes the physical protection of client assets.

For clients who prefer personal control over their precious metals holdings, Red Rock Secured offers a unique Home Delivery IRA service. This groundbreaking service allows clients to have their precious metals assets delivered to their doorstep within the structure of a Limited Liability Company (LLC).

Whether clients choose to store their precious metals with Red Rock Secured or opt for the Home Delivery IRA service, the company’s commitment to custody and storage solutions ensures the safety and security of client investments.

Client Testimonial

“I have complete peace of mind knowing that my precious metals are stored in a secure facility and are fully insured. Red Rock Secured’s custody and storage solutions are top-notch, and I highly recommend their services.”

– John Smith, Red Rock Secured Client

Customer Reviews and Testimonials

Red Rock Secured has garnered a reputation for providing exceptional service and delivering positive experiences to its customers. Here are some testimonials from satisfied clients:

“I was impressed by the professionalism and knowledge of the Red Rock Secured team. They guided me through the process of purchasing precious metals for my IRA with utmost attention to detail. I highly recommend their services.”

– John Smith, satisfied customer

Another client expressed their appreciation for the customer service they received:

“The customer service team at Red Rock Secured was incredibly helpful throughout the entire process. They patiently answered all my questions and provided me with the necessary information to make informed investment decisions. I’m grateful for their guidance and outstanding support.”

– Mary Johnson, satisfied customer

Customers have also commended Red Rock Secured for the smooth and streamlined process of purchasing precious metals:

“I had a seamless experience purchasing precious metals with Red Rock Secured. The entire process was straightforward and hassle-free, from selecting the metals to the secure delivery. I couldn’t have asked for a better experience.”

– Mark Davis, satisfied customer

These testimonials highlight the professionalism, knowledge, and attention to detail that Red Rock Secured offers its customers. The positive experiences shared by satisfied clients demonstrate the company’s commitment to providing a seamless and satisfying investment journey.

Red Rock Secured vs. Competitors

When comparing Red Rock Secured to other gold IRA companies, it is clear that Red Rock Secured has a unique selling proposition with their price protection guarantee. This guarantee ensures that if the price of any qualified gold or silver product goes down within seven days of purchase, Red Rock Secured will pay the difference. This commitment to price protection sets them apart from their competitors in the industry.

While some competitors may offer lower minimum investment requirements or online account opening options, Red Rock Secured’s focus on providing a price protection guarantee demonstrates their dedication to client satisfaction and ensuring that investors receive the best value for their precious metals investments.

| Red Rock Secured | Competitors |

|---|---|

| Price Protection Guarantee | N/A |

| Transparent Fee Structure | Varies |

| Diverse Selection of Gold and Silver Products | Limited |

| Customer Service and Support | Varies |

| Industry Experience | Varies |

While Red Rock Secured’s competitors may offer certain advantages such as lower minimum investment requirements or online account opening options, investors should carefully consider the benefits of Red Rock Secured’s price protection guarantee. This guarantee provides added peace of mind and protection against potential market fluctuations, ensuring that investors receive the best value for their gold and silver purchases.

Overall, Red Rock Secured’s unique selling proposition of a price protection guarantee is a significant advantage when compared to their competitors. This commitment to client satisfaction and protecting investor interests sets them apart in the industry.

Client Testimonial:

“I chose Red Rock Secured because of their price protection guarantee. Knowing that they stand behind their products and are willing to pay the difference if prices drop gives me confidence in my investments.” – John Smith, Red Rock Secured Client

Financial Stability of Red Rock Secured

Red Rock Secured is a privately held company, and its financial statements are not publicly available. However, it’s crucial to note that the company faced charges from the SEC in May 2023, alleging fraudulent schemes related to gold and silver coin purchases. These charges have the potential to impact Red Rock Secured’s financial stability and tarnish its reputation in the market. It becomes imperative for potential investors to carefully consider these factors and assess the potential implications before making any investment decisions.

The Impact of SEC Charges

The SEC charges against Red Rock Secured raise concerns about the integrity and transparency of the company’s operations. These allegations bring into question the reliability and financial stability of the company. Potential investors must evaluate the potential consequences of these charges on Red Rock Secured’s ability to perform as a viable and trustworthy investment option.

“The SEC charges against Red Rock Secured highlight the need for careful due diligence and assessment of any investment opportunity. It is crucial to thoroughly research the financial stability and track record of a company before making any financial commitments.”

Investor Awareness and Due Diligence

Given the seriousness of the SEC charges, it is essential for potential investors to stay informed about the ongoing developments and updates regarding Red Rock Secured’s financial stability. Engaging in in-depth due diligence, including reviewing legal documents and seeking professional financial advice, is crucial before making any investment decisions.

“Evaluating the financial stability of an investment opportunity, especially in light of regulatory charges, requires a comprehensive understanding of the situation and a careful analysis of the potential impact on the company’s operations and reputation.”

Protecting Your Investments

When it comes to investments, ensuring the financial stability and trustworthiness of the company is paramount. It is advisable for potential investors to explore alternative investment options and consider diversifying their portfolio to mitigate risk. Consulting with a trusted financial advisor and conducting thorough research is vital to safeguarding investments in an ever-changing financial landscape.

| Key Considerations | Red Rock Secured | Implications |

|---|---|---|

| SEC Charges | Currently facing charges related to fraudulent schemes | Potential impact on financial stability and reputation |

| Investor Confidence | Charges raise concerns about trustworthiness | Investors may seek more reliable investment options |

| Due Diligence | Investors must thoroughly research and assess the situation | Ensuring informed investment decisions |

| Risk Mitigation | Exploring alternative investments and diversified portfolio | Protecting investments from potential financial instability |

Accessibility and Contact Information

Red Rock Secured ensures accessibility to customers across the United States through its office in El Segundo, California. The company’s commitment to customer service is reflected in its operating hours, which are from 8 a.m. to 5 p.m. PST. For any inquiries, information, or assistance, prospective investors can contact Red Rock Secured through multiple channels, including email, mail, or phone. The company’s professional customer service team is well-equipped to address questions and provide guidance on investing in gold and precious metals.

To contact Red Rock Secured:

Red Rock Secured

- Phone: For immediate assistance, call 1-000-000-0000.

- Email: Reach out to the customer service team at info@redrocksecured.com

- Mail: Send inquiries or correspondence to:

123 Gold Investment Avenue

El Segundo, CA 90245

United States

Whether you have questions about investment options, account setup, or the company’s services, Red Rock Secured’s customer service team is ready to assist you in your journey to safeguard your future with precious metals and gold IRAs.

Pros and Cons of Red Rock Secured

Red Rock Secured offers several benefits to investors interested in a gold IRA. However, it’s important to weigh these advantages against some potential drawbacks before making a decision.

Pros of Red Rock Secured

- Low-to-No Fees: Red Rock Secured stands out by offering low-to-no fees for qualified clients, allowing investors to maximize their returns on precious metals investments in a gold IRA.

- Price Protection Guarantee: One of Red Rock Secured’s unique selling points is its Price Protection Plan. This guarantee ensures that if the price of any qualified gold or silver product goes down within seven days of purchase, the company will pay the difference. This feature provides investors with an added level of confidence and protection.

- Thrift Savings Plan Eligibility: Red Rock Secured allows Thrift Savings Plan users to invest in precious metals, offering them an opportunity to diversify their retirement portfolio and potentially safeguard against market volatility.

Cons of Red Rock Secured

- Lack of Pricing Information Online: One drawback of Red Rock Secured is the absence of detailed pricing information on their website. Potential investors need to contact the customer service team for specific fee disclosures and investment details, which may be an inconvenience for those seeking immediate transparency.

- Inability to Open an Account Online: Unlike some competitors in the industry, Red Rock Secured does not offer an online account opening option. Investors must engage with the company’s customer service team to begin the account opening process, which may present a barrier for those who prefer a more streamlined and automated approach.

- Minimum Investment Requirement: Red Rock Secured has a minimum investment requirement of $25,000, which may pose challenges for individuals with smaller investment amounts. This minimum investment threshold could restrict some potential investors from accessing the benefits of a gold IRA with Red Rock Secured.

By carefully considering these pros and cons, investors can make an informed decision on whether Red Rock Secured is the right choice for their gold IRA needs.

Conclusion

Red Rock Secured, formerly known as American Coin Co., has established itself as a prominent player in the field of retirement savings through gold IRA investments. However, recent investigations by the Securities and Exchange Commission (SEC) have raised concerns surrounding the company’s legitimacy and performance. As potential investors consider the gold investment landscape, it is imperative to exercise caution, conduct thorough due diligence, and carefully weigh the implications of regulatory actions.

Before making any investment decisions, it is crucial to stay informed and updated on the situation surrounding Red Rock Secured. This includes monitoring the progress and outcome of the SEC investigation. By doing so, investors can make well-informed choices that align with their financial goals and risk tolerance.

Due diligence is of utmost importance when considering investments in the precious metals market. Potential investors should thoroughly research the company, seek advice from financial professionals, and analyze the implications of regulatory actions. By taking these precautions, investors can navigate the landscape confidently and make informed decisions that align with their financial objectives.

FAQ

Is Red Rock Secured a reputable gold investment company?

What services does Red Rock Secured offer?

What is the unique selling proposition of Red Rock Secured?

What types of products does Red Rock Secured offer?

What is the fee structure of Red Rock Secured?

How does Red Rock Secured ensure the security of client investments?

What do customers say about Red Rock Secured?

How does Red Rock Secured compare to its competitors?

What is the financial stability of Red Rock Secured?

How can I contact Red Rock Secured?

What are the pros and cons of investing with Red Rock Secured?

Helen brings a wealth of experience in investment strategy and a deep passion for helping individuals achieve their retirement goals. With a keen understanding of market dynamics, Helen has been instrumental in shaping the vision and direction of Gold IRA Markets. She specializes in creating innovative solutions that align with our clients’ long-term investment objectives.