To strategically plan for your retirement in South Dakota, consider incorporating IRAs with state-specific benefits such as the SDRS. The SDRS offers crucial retirement, disability, and survivor benefits for public employees, ensuring financial stability. Utilizing IRAs, particularly self-directed options, provides tax advantages and investment flexibility. Given South Dakota’s exemption of state income tax on IRA withdrawals, you can optimize your savings potential. Understanding the intricacies of both SDRS and IRAs will strengthen your retirement plan. There is a wealth of information to explore about optimizing your retirement strategy, including valuable resources to assist with well-informed decisions.

Key Takeaways

- South Dakota public employees participate in SDRS, which provides essential retirement, disability, and survivor benefits through mandatory contributions.

- IRAs offer tax advantages including tax-deferred growth and potential tax-deductible contributions, enhancing retirement savings.

- South Dakota has no state income tax on IRA withdrawals, maximizing retirement income for residents.

- Self-directed IRAs provide investment flexibility, allowing individuals to invest in diverse assets like real estate and precious metals.

- Utilizing SDRS alongside IRAs creates a comprehensive retirement strategy tailored to individual financial goals and state-specific benefits.

Importance of Retirement Planning

Retirement planning's significance can't be overstated, especially in South Dakota, where many households struggle to save adequately for their future. A solid retirement savings plan is essential for ensuring you have enough income during your retirement years.

Engaging in proactive planning allows you to take advantage of tax benefits linked to various accounts such as IRAs and the South Dakota Retirement System (SDRS) Supplemental Retirement Plan (SRP).

Many low to moderate-income workers in South Dakota benefit from state-sponsored retirement plans that aim to bridge the retirement savings gap. The SDRS provides public employees with vital retirement, disability, and survivor benefits, highlighting the importance of making early and consistent contributions.

Consulting with financial advisors can help you navigate your options and tailor a retirement strategy that fits your needs. Ongoing financial education initiatives in South Dakota further empower you to understand and leverage available retirement options, encouraging participation in employer-sponsored plans.

Overview of South Dakota Retirement Programs

When you work as a full-time public employee in South Dakota, you're automatically enrolled in the South Dakota Retirement System (SDRS).

This program offers valuable benefits, including retirement, disability, and survivor options, all tailored to guarantee your financial security.

Understanding the membership requirements and the specific benefits available can help you plan effectively for your future.

SDRS Membership Requirements

For full-time public employees in South Dakota, joining the South Dakota Retirement System (SDRS) is a requirement right from the start of their careers. This membership is mandatory for all eligible employees, including state workers, teachers, and local government staff.

Once you begin your employment, contributions to SDRS are automatically deducted from your salary, helping you build your retirement benefits over time.

To qualify for these benefits, you must complete a vesting period of three years of service. This means you need to work for a minimum of three years in a qualifying position to become fully vested in the pension plans provided by SDRS. During this time, you'll accumulate retirement benefits that reflect both your years of service and salary.

The SDRS is managed by a Board of Trustees, ensuring compliance with South Dakota Codified Laws and the effective oversight of the pension plans.

Benefits of SDRS Plans

The South Dakota Retirement System (SDRS) offers a solid foundation for public employees looking to secure their financial future. As a member, you'll enjoy a variety of benefits designed to provide financial security in retirement. SDRS includes pension plans for state employees, teachers, and local government workers, guaranteeing you're covered throughout your career.

You'll appreciate the range of benefits SDRS provides, including retirement, disability, and survivor benefits. With a typical three-year vesting period, you'll need to accumulate sufficient service time before accessing these benefits.

Additionally, SDRS often includes cost-of-living adjustments (COLA), helping your retirement income keep pace with inflation.

Funding for SDRS comes from member contributions, employer matching, and investment earnings. The system emphasizes diversified investment options to guarantee sustainability, giving you peace of mind about your future.

Recent legislative changes have also improved access to financial education and retirement planning resources, empowering you to make informed decisions about your retirement strategy.

Benefits of IRAs in Retirement

When it comes to retirement planning, IRAs can really boost your savings with their tax advantages.

A well-structured IRA, including options like a Gold IRA, can provide protection against inflation and market downturns, enhancing the stability of your retirement portfolio.

You can choose from a variety of investment options, giving you the flexibility to tailor your portfolio to your goals.

Understanding how these benefits work can help you make smarter financial decisions for your future.

Tax Advantages Explained

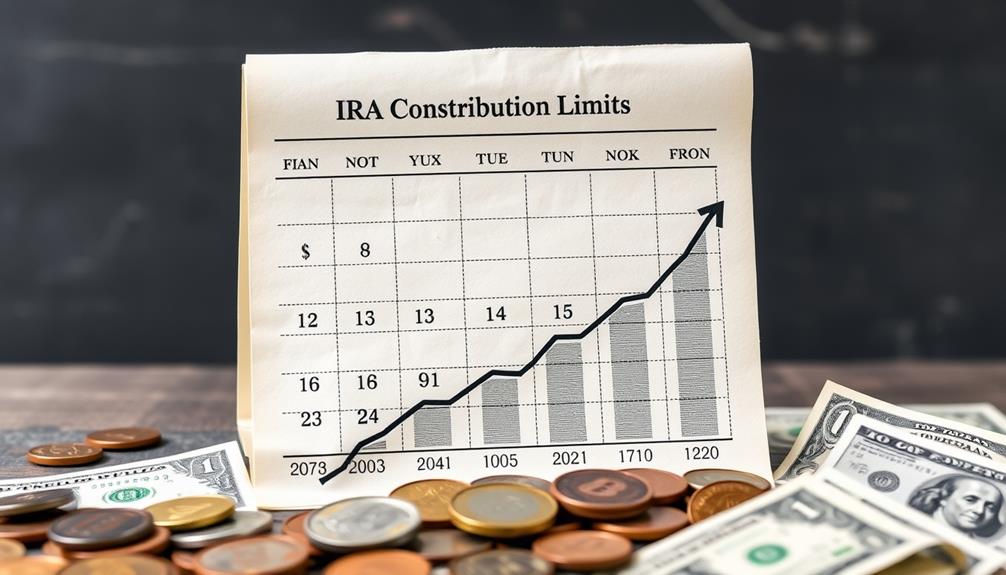

Many retirees find that Individual Retirement Accounts (IRAs) offer significant tax advantages, making them a popular choice for building a secure financial future. One major benefit is tax-deferred growth, which allows your investments to accumulate without immediate taxation until you withdraw funds. This can lower your overall tax liability during retirement.

Additionally, investing in precious metals through a Gold IRA can provide a hedge against inflation and market volatility, enhancing your retirement portfolio's resilience. Gold IRA offerings can be an excellent way to diversify your investments.

Contributions to traditional IRAs may even be tax-deductible, providing potential tax savings in the year you make them, depending on your income limits and participation in other retirement plans. On the other hand, Roth IRAs enable tax-free withdrawals in retirement since you contribute after-tax dollars. This can be particularly beneficial if you expect to be in a higher tax bracket later on.

As a South Dakota resident, you also enjoy state tax benefits associated with IRAs, as there's no state income tax. This enhances the overall growth potential of your retirement savings.

Additionally, the ability to roll over funds from employer-sponsored plans into an IRA without incurring tax penalties gives you greater flexibility in managing your retirement assets while maximizing these valuable tax advantages.

Investment Flexibility Overview

Investing in Individual Retirement Accounts (IRAs) opens up a world of flexibility, allowing you to customize your retirement strategy. With various IRA options available in South Dakota, like Traditional and Roth IRAs, you can choose the one that best fits your financial goals. Each option offers distinct tax advantages, letting you maximize your retirement savings through tax-deferred growth.

The investment strategies you can employ within an IRA are incredibly diverse. You're not limited to just stocks and bonds; you can also invest in mutual funds, real estate, and even precious metals if you opt for self-directed IRAs. This flexibility means you can tailor your portfolio to align with your risk tolerance and financial aspirations, enhancing your potential returns over time.

Additionally, South Dakota's lack of state income tax on IRA withdrawals means you can keep more of your hard-earned money for your retirement. This advantage further amplifies the effectiveness of your retirement savings, allowing you to enjoy the fruits of your investments without the burden of state taxation.

Embrace the investment flexibility of IRAs to build a robust retirement strategy that truly meets your needs.

State-Specific Retirement Benefits

Understanding state-specific retirement benefits is essential for public employees in South Dakota, as they navigate their financial futures. The South Dakota Retirement System (SDRS) offers a structured pension plan for eligible workers, including state employees, teachers, and local government staff. Membership in SDRS is mandatory, ensuring that you'll need to meet a typical vesting period of three years to qualify for retirement benefits.

While South Dakota lacks a state-mandated retirement plan, the SDRS provides valuable retirement programs, including disability and survivor benefits. The SDRS maintains a diversified investment portfolio, which helps sustain the fund's solvency and enables cost-of-living adjustments (COLA) for retirees.

It's vital to stay informed about these benefits, as they play a significant role in your overall retirement strategy. Consulting a financial advisor can help you understand how to maximize your SDRS benefits alongside your personal retirement savings.

Be aware of the IRS maximum contribution limits for IRAs, as they can impact your overall account balance. By integrating these insights, you can effectively plan for a secure and comfortable retirement in South Dakota.

Integrating Self-Directed IRAs

Alongside the benefits offered by the South Dakota Retirement System, integrating self-directed IRAs can greatly enhance your retirement strategy.

These accounts give you the freedom to diversify your retirement savings by investing in various asset classes. Here are three key advantages of self-directed IRAs:

- Tax Advantages: Like traditional IRAs, self-directed IRAs offer tax-deferred growth, allowing your investments to compound without immediate tax implications. This can notably boost your overall retirement savings.

- Investment Control: You have greater control over your investment choices, including real estate, private companies, and precious metals. This flexibility can help you tailor your portfolio to your financial goals.

- Estate Planning: Self-directed IRAs can play an important role in your estate planning strategies, allowing you to allocate assets in a way that maximizes financial security for your beneficiaries.

However, it's essential to consult knowledgeable financial advisors to navigate complex IRS rules.

Proper management is critical to avoid potential penalties and guarantee your investments align with your retirement goals.

Risks of Self-Directed IRAs

Maneuvering the world of self-directed IRAs can be challenging, especially when you consider the variety of risks involved.

One important risk is the lack of regulatory oversight for many non-traditional investments. This absence can lead to poor investment choices that might jeopardize your retirement savings, particularly in the case of avoiding gold IRA scams. Additionally, alternative investments like real estate often suffer from liquidity issues, making it tough to access funds when you need them.

You also need to keep in mind the complexity of managing a self-directed IRA. Strict adherence to IRS regulations is essential; unintentional violations can result in severe penalties, including taxes that could erase your tax-advantaged benefits.

Valuing non-traditional assets can be subjective and often requires professional appraisals, adding another layer of complication.

Lastly, failing to comply with IRS rules can lead to the loss of your IRA's tax-advantaged status, greatly impacting your financial future.

To navigate these risks successfully, thorough due diligence and a solid understanding of the regulations are vital. Take your time, do your research, and consult professionals as needed to protect your investments.

Resources for Retirement Planning

Steering retirement planning in South Dakota can be much smoother with the right resources at your disposal. Utilizing the South Dakota Retirement System (SDRS) can greatly enhance your retirement strategy, especially if you're a public employee.

Here are three essential resources to take into account:

- Supplemental Retirement Plans (SRPs): SDRS offers SRPs that let you contribute pre-tax or Roth funds, providing you flexibility in your retirement plans. You can even make catch-up contributions if you're over 50.

- Investment Options: SDRS provides various investment options tailored to different risk tolerances. You can align your investment choices with your financial goals, ensuring your IRAs and retirement plans work for you.

- Financial Literacy Resources: SDRS hosts educational workshops to improve your financial literacy. These resources empower you to make informed decisions about your retirement planning, helping you navigate the complexities of investment options and savings strategies.

Frequently Asked Questions

Can You Combine State and Federal Retirement?

Yes, you can combine state and federal retirement accounts. By strategically rolling over funds and considering contribution limits, you'll maximize your savings potential. Consulting a financial advisor helps you navigate the regulations effectively.

What Is the South Dakota Retirement System Pension Plan?

Imagine planting a tree; the South Dakota Retirement System is your fertile ground. You'll earn pension benefits based on your years of service and salary, providing financial security as you enjoy the shade of retirement.

What Is the Rule of 85 for Retirement in South Dakota?

The Rule of 85 lets you retire without benefit reduction when your age plus service years equals 85 or more. It encourages longer service, offering you flexibility and promoting financial security in retirement.

Is South Dakota Retirement Friendly?

Imagine a tree thriving in rich soil; that's South Dakota for retirees. With no state income tax and solid pension plans, you'll find it's a friendly place for your retirement dreams to grow and flourish.

Conclusion

As you navigate the winding river of retirement planning in South Dakota, remember that integrating IRAs with state-specific benefits is like finding hidden tributaries that enrich your journey. Each decision, like a careful stroke of your paddle, helps steer you toward a secure financial future. Embrace the resources available, and don't shy away from the twists and turns; they can lead to fruitful destinations. With thoughtful planning, you can transform your retirement dreams into a reality as vibrant as the South Dakota landscape.

Helen brings a wealth of experience in investment strategy and a deep passion for helping individuals achieve their retirement goals. With a keen understanding of market dynamics, Helen has been instrumental in shaping the vision and direction of Gold IRA Markets. She specializes in creating innovative solutions that align with our clients’ long-term investment objectives.