In New York, IRA withdrawals are subject to state income tax, which ranges from 4% to 10.9%. If you are 59 and a half years old or older, you can exclude the first $20,000 of your total retirement income from state and city taxes. Traditional IRA withdrawals are fully taxable if they are made from deductible contributions. It’s important to remember that withholding tax forms are essential for managing your tax responsibilities when making withdrawals. If you are a non-resident, you will only owe state taxes on income earned in New York. For a better understanding of these implications, it may be helpful to explore additional insights and guidelines.

Key Takeaways

- New York State taxes IRA withdrawals, with rates ranging from 4% to 10.9% based on income levels.

- Residents aged 59½ or older can exempt the first $20,000 of IRA distributions from state and city taxes.

- Withdrawals from traditional IRAs are fully taxable if all contributions were deductible; partial taxation applies to non-deductible contributions.

- Non-residents are only liable for state taxes on services performed within New York, not on IRA withdrawals.

- Consulting a tax professional is advisable to navigate withholding and tax implications effectively.

Overview of New York Taxes

When it comes to understanding New York taxes, it's crucial to know how various tax rates and exemptions can impact your finances. New York State has a progressive income tax system, with rates ranging from 4% to 10.9%, depending on your income level and filing status.

If you live in New York City, you'll face additional City income tax, which can greatly increase your overall tax liability.

Property taxes are another consideration, with an average rate of 1.4% of your home's assessed value. Counties like Nassau, Rockland, and Westchester have some of the highest median property taxes in the state.

When it comes to retirement, if you're withdrawing from an IRA, you must also consider the tax implications. New York offers various exemptions, including a $20,000 annual state and city tax exemption on eligible IRA distributions.

Understanding these nuances can help you optimize your tax situation. By staying informed about New York's tax rates and available exemptions, you can make smarter financial decisions and potentially reduce your overall tax burden.

Required Minimum Distributions

Once you hit age 73, you'll need to start taking Required Minimum Distributions (RMDs) from your IRA by April 1st of the following year.

The IRS provides a Uniform Lifetime Table to help you calculate the minimum amount you must withdraw annually.

Understanding RMDs is essential to avoid hefty penalties and guarantee you're meeting your tax obligations.

RMD Start Age

Understanding the RMD start age is vital for managing your retirement savings effectively. In New York, you must begin taking Required Minimum Distributions (RMDs) from your traditional IRAs by April 1st of the year following your 73rd birthday.

These distributions are essential for ensuring you meet your retirement income needs while also adhering to federal income tax obligations. If you fail to withdraw the required amount, you could face a hefty penalty of 50% on the taxable amounts that should've been withdrawn.

It's significant to highlight that RMDs apply exclusively to traditional IRAs; Roth IRAs don't require distributions during your lifetime.

When calculating RMDs, you'll typically use the Uniform Lifetime Table unless your spouse is your beneficiary and is at least ten years younger than you, in which case the Ordinary Joint Life and Last Survivor Annuities Table applies.

Distribution Period Calculation

Calculating your Required Minimum Distributions (RMDs) involves using specific IRS tables to guarantee you withdraw the correct amount each year. In New York State, the distribution period starts by April 1st of the year following your 73rd birthday. You'll typically use the Uniform Lifetime Table for this calculation, factoring in your IRA assets and life expectancy factor.

Here's a simplified breakdown of how RMDs are calculated:

| Year | Account Balance | Life Expectancy Factor |

|---|---|---|

| 2023 | $100,000 | 27.4 |

| 2024 | $90,000 | 26.5 |

| 2025 | $80,000 | 25.6 |

To determine your RMD, divide your account balance at the end of the previous year by the life expectancy factor from the applicable table. Remember, if you withdraw more than the required amount, it won't count toward future RMDs. Also, be cautious—failing to take the RMD can lead to a hefty 25% penalty from the federal government on the taxable amounts you should have withdrawn. Keep your finances in check to avoid unnecessary penalties!

Withdrawing From NYCE IRA

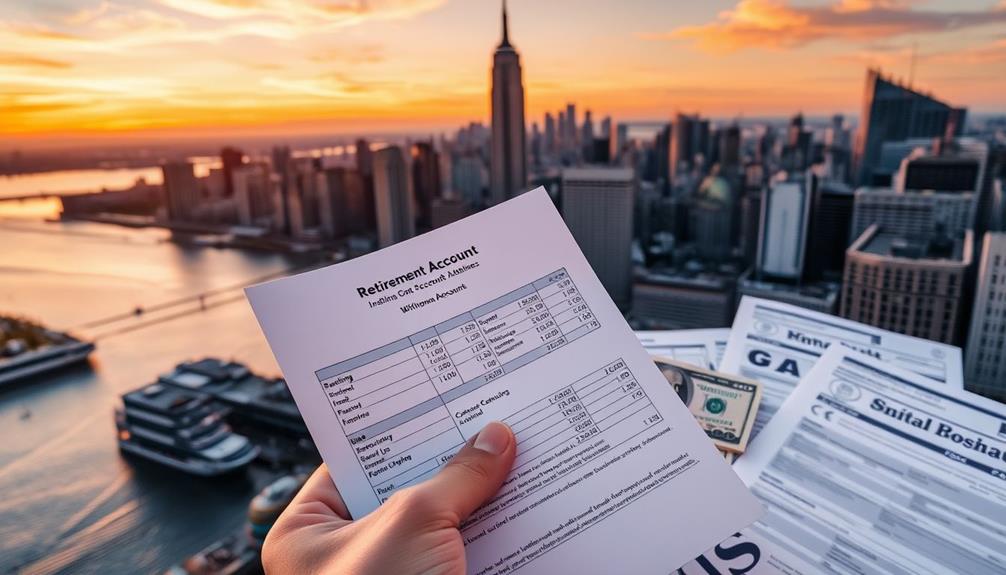

When you're ready to withdraw from your Traditional NYCE IRA, you'll need to complete the Traditional NYCE IRA Withdrawal Form for either full or partial distributions.

It's essential to understand that your withdrawals can have tax implications, both federally and at the state level.

If you're over 59½, you might also be eligible for a significant tax exemption on your distributions.

Withdrawal Process Overview

Withdrawing funds from your Traditional NYCE IRA involves a straightforward process that guarantees you can access your savings as needed.

To initiate a Traditional NYCE IRA withdrawal, you'll need to complete and submit the Traditional NYCE IRA Withdrawal Form, which allows for both full and partial distributions. This flexibility means you can schedule your withdrawals as periodic payments—monthly, quarterly, semi-annually, or annually—depending on your financial needs.

If you face special circumstances like death, disability, or divorce, be sure to contact the NYCE IRA Administrative Office for specific guidelines tailored to these situations.

While you can withdraw funds at any time, keep in mind that tax implications may apply, which could affect the net amount you receive.

For assistance managing the withdrawal process or understanding any potential tax implications, don't hesitate to reach out to NYCE IRA at (212) 306-7760 or 1-888-IRA-NYCE if you're outside NYC.

This way, you can make sure you're making informed decisions regarding your IRA withdrawals in New York State.

Tax Implications Explained

Understanding the tax implications of withdrawing from your Traditional NYCE IRA is essential for making informed financial decisions. When you take IRA withdrawals, you'll face both federal and New York State income taxes on the distributions made.

Generally, the earnings in your Traditional NYCE IRA grow tax-deferred until you withdraw them, but that doesn't mean your distributions are tax-free.

For those aged 59½ or older, the first $20,000 of retirement income from IRAs and qualified plans can be exempt from New York state income tax if you take periodic payments. However, if your IRA only contains deductible contributions, the entire distribution may be taxable. If you have non-deductible contributions, only a portion will be subject to tax.

For federal income tax withholding, the default assumes married status with three allowances, but you can adjust this with a W-4P withholding certificate.

If you're a non-resident receiving distributions, you'll only owe New York state taxes for services performed within the state, but you can still benefit from the same $20,000 exemption if you meet the age requirement.

Understanding these nuances can help you manage your tax liability effectively.

Tax Implications of Withdrawals

Maneuvering the tax implications of IRA withdrawals can be complex, especially when it comes to traditional NYCE IRAs. You need to understand that withdrawals are generally subject to federal and New York State taxes, with earnings growing tax-deferred until you take distributions.

If you only made deductible contributions, the entire amount you withdraw might be fully taxable. However, if you've made non-deductible contributions, your distribution will be partly taxable.

Here are some key points to keep in mind:

- Individuals 59½ or older can benefit from a $20,000 annual state and city tax exemption on cumulative distributions from retirement plans.

- Tax-free portions of your withdrawals correspond to non-deductible contributions, which you must track for accurate tax reporting.

- IRS Publication 590 offers detailed guidance on calculating the taxable amounts of IRA distributions.

- Understanding your basis in non-deductible contributions helps in determining what portion of your withdrawal is taxable.

- Proper tax planning is essential to avoid unexpected tax liabilities upon withdrawal.

Withholding Tax Considerations

When you tap into your IRA funds, withholding tax considerations become vital for managing your finances. For IRA withdrawals, you can specify federal income tax withholding by submitting a W-4P withholding certificate. This allows you to determine the appropriate amount withheld from your distributions made.

Keep in mind that for periodic distributions, the default withholding assumes you're married with three allowances, which mightn't reflect your actual tax situation.

If you're taking a non-periodic distribution, a mandatory 10% federal withholding rate applies, markedly impacting the net amount you receive. Additionally, state tax and local tax withholding may also come into play, further influencing your overall tax burden on these distributions.

Since decisions regarding tax withholding can directly affect the amount of money you have available in retirement, it's important to consult a tax professional. They can help you navigate the intricacies of withholding tax and identify any non-taxable amounts that may apply, ensuring you make informed decisions as you manage your IRA withdrawals in New York.

State Tax Exemptions for Withdrawals

New York offers considerable tax exemptions for IRA withdrawals, especially for residents aged 59½ and older. If you fall into this age group, you can exempt the first $20,000 of cumulative distributions from various retirement plans, including IRAs, from state and city taxes. This exemption applies to both periodic payments and lump-sum distributions.

Here are some key points about these tax exemptions for New York residents:

- The $20,000 exemption includes distributions from qualified retirement plans.

- Beneficiaries receiving distributions from deceased individuals can also qualify, as long as they meet the age requirement.

- You must be a New York resident to take advantage of these tax exemptions.

- The distributions should be part of employer-employee relationships or retirement plans.

- This exemption complements the state income tax exemption for public retirement benefits, enhancing tax relief for eligible retirees.

Understanding these tax exemptions can greatly impact your financial planning in retirement.

Retirement Income Taxation

Understanding retirement income taxation is essential for effective financial planning during your retirement years. In New York State, when you take IRA withdrawals, these funds are subject to state income tax. The rates range from 4% to 10.9%, depending on your overall income level.

If you're 59½ or older, you can exempt the first $20,000 of your retirement income, which includes distributions from IRAs and qualified retirement plans.

It's important to note that public pension income from New York state government is exempt from state taxation, providing relief for retired government employees. However, any retirement income exceeding the $20,000 exemption threshold will be taxed at the applicable income tax rates, which vary by income brackets.

Additionally, Social Security benefits aren't subject to New York state taxes, giving retirees relying on these benefits an extra layer of financial relief.

Understanding how these factors impact your taxable amounts will help you make informed decisions regarding your retirement income. By being aware of these rules, you can better plan your withdrawals and optimize your financial situation during retirement.

Resources for Tax Assistance

Finding reliable resources for tax assistance can make a significant difference in managing your IRA withdrawals and understanding their implications. In New York City, you have access to several valuable services to help you navigate this complex landscape.

- AARP Foundation Tax-Aide: Offers free tax assistance, especially for individuals over 50.

- IRS Publication 590: A vital resource that details the tax implications of IRA distributions, helping clarify taxable versus non-taxable amounts.

- NYCE IRA: Contact them at (212) 306-7760 or 1-888-IRA-NYCE for specific guidance on withdrawal processes and state tax implications.

- In-person and Virtual Help: The AARP program provides both options, ensuring you can find the support that fits your needs.

- Trained Volunteers: You'll receive help from volunteers trained by the IRS, who are knowledgeable about retirement benefits and tax assistance.

Utilizing these resources can empower you to make informed decisions about your IRA withdrawals while minimizing any potential tax burdens.

Frequently Asked Questions

Do I Pay State Tax on IRA Withdrawal?

Yes, you'll pay state tax on your IRA withdrawal unless you're 59.5 or older, in which case you can exclude the first $20,000. Always check your state's specific tax rules to stay informed.

Does NY State Tax Inherited IRA Distributions?

Imagine a garden where every flower blooms, but some carry a hidden cost. Yes, New York does tax inherited IRA distributions, so you'll need to prepare for those financial petals to fall into your wallet.

What Are the Tax Implications of Withdrawing From Ira?

When you withdraw from your IRA, you typically face federal income tax on the taxable amount. Depending on your state, you might also owe state taxes, affecting your overall withdrawal strategy and retirement planning.

Do I Have to Pay NY State Tax on My Pension?

Yes, you'll have to pay New York state tax on your pension, but if you're 59½ or older, you can benefit from a $20,000 annual exemption, which reduces your taxable income considerably.

Conclusion

Maneuvering the world of IRA withdrawals in New York doesn't have to feel like an intimidating maze. With a little understanding of state tax implications, you can make the most of your hard-earned savings. Remember, while taxes may seem like a pesky companion on your retirement journey, you can enjoy the ride by staying informed and planning wisely. So, take a deep breath, and embrace your financial future with confidence!