Recent record-breaking gold purchases by central banks signal a strategic shift toward gold as a hedge against geopolitical and economic uncertainties. Despite fluctuations, they’re increasing reserves, especially among emerging markets, to reduce reliance on US assets and boost financial resilience. This continuous accumulation supports long-term gold stability and hints at ongoing de-dollarization efforts. If you pay attention, you’ll uncover how this trend could impact your investment approach over time.

Key Takeaways

- Record central bank gold purchases signal strong long-term demand, supporting gold’s stability and potential appreciation.

- Increased accumulation reflects strategic diversification and de-dollarization efforts, reducing reliance on US assets.

- Ongoing demand provides a resilient foundation for gold prices, even amid cyclical market downturns.

- Rising gold reserves enhance geopolitical and economic hedge, boosting gold’s role in long-term portfolio safety.

- Underreported buying activity and strategic reserves indicate robust institutional confidence in gold’s value.

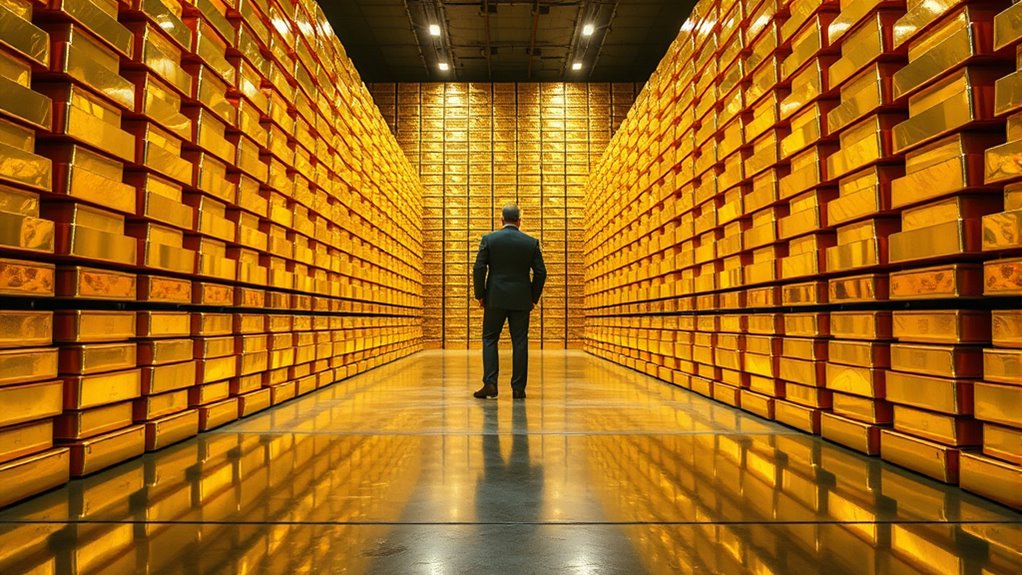

Despite a slight decline from the previous year, central banks launched a record-breaking gold buying spree in the first quarter of 2025, purchasing 244 tonnes. Although this marks a 21% decrease compared to Q1 2024’s 310 tonnes, it still exceeds the five-year quarterly average by 25%. This indicates that, despite fluctuations, central banks remain committed to accumulating gold, reflecting a broader strategy of diversification and risk mitigation. Poland’s contribution stands out, adding 49 tonnes and raising its reserves to 497 tonnes, a move emblematic of a wider trend of strategic reserve buildup among emerging markets seeking stability amid geopolitical tensions and economic uncertainties. Official data suggests that actual central bank gold purchases may be higher due to reporting gaps and off-book acquisitions, underscoring the true scale of their demand. Your long-term perspective should recognize that central bank gold buying has been a consistent feature over the past three years, signaling a deliberate shift away from reliance on US dollar assets. This de-dollarization effort is driven by a desire to reduce exposure to US monetary policy and dollar fluctuations, especially as geopolitical tensions escalate globally. With central banks holding roughly 36,200 tonnes of gold—20% of official reserves—their increasing accumulation underscores gold’s role as a strategic hedge and safe-haven asset. This trend isn’t just about short-term market moves; it’s a calculated move to bolster resilience against economic shocks and currency volatility. Market dynamics reveal that central bank demand provides long-term support for gold prices, even amid cyclical downturns. While local markets like China experience selling pressure, official sector accumulation continues unabated. The forecast for 2025 suggests annual purchases around 900 tonnes, slightly below last year’s levels, but enough to sustain upward price momentum. This sustained demand helps to stabilize gold prices over time, as central banks’ strategic purchases counteract downward cycles driven by other market forces. Geopolitical factors reinforce this pattern. Nearly 81% of central banks plan to continue accumulating gold, viewing it as a crucial hedge amid political instability and economic uncertainty. The momentum of de-dollarization accelerates the appeal of gold, especially as emerging markets seek to diversify reserves and reduce reliance on US assets. Historical trends show that during periods of heightened uncertainty, central banks tend to increase gold holdings, emphasizing its importance in strategic reserve management. From a long-term investor’s perspective, these developments signal that gold remains a resilient store of value. While official figures might underreport actual demand due to strategic purchases or reporting gaps, the overall trend points to sustained interest. Furthermore, the role of gold in portfolio diversification reinforces that gold’s role as a crisis hedge and diversification tool will likely persist, supporting prices and emphasizing its significance within global reserves. Additionally, advancements in financial reporting transparency could lead to more accurate data on central bank gold acquisitions in the future. Recognizing the importance of central bank policies can help investors better anticipate future market movements. The strategic accumulation of gold by central banks demonstrates their increasing recognition of gold’s value as a reserve asset, further strengthening its position in global financial stability. This record-breaking buying spree reflects a broader shift toward safeguarding wealth against geopolitical and economic turbulence, making gold an essential component of strategic portfolio planning for the future.

Frequently Asked Questions

How Might Increased Gold Reserves Impact Global Currency Stability?

You might see increased gold reserves boost global currency stability because central banks diversify their holdings, reducing reliance on any single currency. By holding more gold, they can better hedge against inflation, economic shocks, and geopolitical tensions. This strategy helps maintain confidence in their currencies, stabilizes exchange rates, and minimizes volatility. As a result, increased gold reserves can create a more resilient financial system and promote long-term stability worldwide.

What Are Central Banks’ Long-Term Goals With Gold Accumulation?

You should understand that central banks accumulate gold to achieve long-term goals like diversifying reserves and reducing dependence on the US dollar. They aim to enhance economic sovereignty, hedge against inflation, and strengthen their currencies’ international standing. By building substantial gold reserves, they seek financial stability, protect against geopolitical risks, and support their monetary policy independence, ensuring resilience amid global economic uncertainties.

Could This Gold Buying Trend Influence Inflation Rates Worldwide?

You wonder if central bank gold buying impacts global inflation. When they increase reserves, it signals confidence in gold as a hedge, which can reduce fears of currency devaluation. This shift might stabilize or even lower inflation expectations by diversifying away from fiat currencies. However, if gold prices rise sharply due to heavy buying, it could trigger inflationary pressures in the broader economy, especially if it affects consumer and investor behavior.

Are Private Investors Affected by Central Bank Gold Purchasing Strategies?

Think of central bank gold buying as a lighthouse guiding your investment ship through stormy seas. While they’re purchasing vast amounts, it signals confidence in gold’s stability, encouraging you to contemplate it as a safe haven. Their strategies influence market sentiment, pushing prices higher. You’re affected because their actions often lead to increased demand and volatility, prompting you to adjust your portfolio with cautious optimism, especially during uncertain economic times.

How Does Gold Buying Relate to Geopolitical Tensions and Economic Crises?

You should see gold buying as a strategic response to geopolitical tensions and economic crises. Central banks increase their gold reserves to hedge against instability, currency fluctuations, and inflation. This trend reflects a move toward diversification and safety, especially during conflicts or financial turmoil. As a long-term investor, understanding this pattern helps you recognize gold’s role as a resilient asset during uncertain times.

Conclusion

As a long-term investor, you might wonder if central banks’ record gold purchases signal upcoming economic instability. While some see it as a safe haven move, others believe it’s a strategic diversification. The truth is, history shows central banks often buy gold during uncertain times, but it doesn’t guarantee future crises. Keep an eye on these trends, and consider gold’s role in your portfolio as a hedge — it might just be a sign of cautious optimism.