Deciding when to claim Social Security depends on your health, finances, and plans for longevity. Claiming at 62 gives you quick cash but lowers your monthly benefits and total lifetime payout. Waiting until 67 offers full benefits, while delaying until 70 maximizes monthly income and survivability. Consider your needs, life expectancy, and spousal benefits to find the best fit. Explore further to discover strategies that balance immediate needs with long-term security.

Key Takeaways

- Claiming at 62 provides immediate income but reduces monthly benefits by about 30%, potentially lowering total lifetime payout.

- Waiting until full retirement age (67) yields full benefits without reduction, offering predictable income aligned with retirement planning.

- Delaying benefits until age 70 increases monthly payments by 8% annually, maximizing lifetime benefits for longevity planning.

- Consider health, expected lifespan, and financial needs to determine whether early, on-time, or delayed claiming best suits your situation.

- Coordinating claiming ages can optimize spousal and survivor benefits, balancing immediate needs with long-term household security.

How Claiming at 62 Affects Your Monthly Benefits

Have you considered how claiming Social Security benefits at age 62 will impact your monthly check? When you choose to claim early, your monthly benefit is permanently reduced—by about 30% compared to what you’d receive at full retirement age. For example, if your full retirement benefit is $4,018, claiming at 62 drops it to roughly $2,831. This reduction reflects the actuarial adjustment for early retirement, meaning you’ll get smaller payments overall. While claiming early can provide immediate financial relief, it often results in a lower lifetime benefit. If you’re in poor health or facing urgent financial needs, claiming at 62 might be necessary. However, it’s important to weigh the long-term effects of a reduced monthly income against your current circumstances. Understanding how self watering plant pots work can help you better manage your resources and plan for the future.

The Financial Advantages of Waiting Until Full Retirement Age

Waiting until your full retirement age to claim Social Security benefits can considerably enhance your financial security in retirement. By doing so, you avoid the permanent benefit reduction seen with early claims and receive your full entitled amount. This approach provides a predictable income, aligning with your long-term financial plan. Additionally, benefits claimed at full retirement age are actuarially balanced, ensuring your total lifetime payout is fair. To illustrate, consider the following:

| Claiming Age | Monthly Benefit | Total Lifetime Payout |

|---|---|---|

| 62 | $2,831 | Lower |

| 67 (FRA) | $4,018 | Balanced |

| 70 | $5,108 | Higher |

| 65 | $3,600 | Moderate |

| 69 | $4,700 | Slightly higher |

Choosing to wait maximizes your benefits, offering greater financial stability later in life.

Maximizing Income by Delaying Benefits to Age 70

Delaying your Social Security benefits until age 70 is a strategic move to maximize your retirement income. Each year you wait beyond full retirement age, your benefit increases by 8% through delayed retirement credits, boosting your monthly payout. Claiming at 70 can result in a maximum benefit of around $5,108 in 2025 for those with maximum earnings. This higher benefit provides greater monthly income and better protection against inflation over time. It’s especially advantageous if you expect to live well into your 80s or beyond, as the increased payments can notably improve your financial security. However, this decision depends on your health, longevity expectations, and financial needs. If you’re confident in a longer life span, delaying benefits can be a powerful way to maximize your lifetime Social Security income. Additionally, understanding the history of Halloween and its evolving traditions can help you plan festive activities that honor its cultural significance while enjoying the holiday to its fullest.

Key Factors to Consider When Deciding the Best Time to Claim

Choosing the ideal time to claim your Social Security benefits involves weighing several critical factors that can profoundly influence your retirement income. You need to think about your current financial situation, health, and life expectancy. Additionally, think about your work plans and whether you want to continue earning income. Here are key factors to evaluate:

- Financial needs: Do you require immediate income or can you wait?

- Health and longevity: Are you in good health, expecting a longer life?

- Spousal benefits: Will claiming early or later affect your spouse’s benefits?

- Long-term planning: How do your claiming age choices align with your retirement goals?

Balancing these considerations helps determine the most advantageous claiming strategy for your unique circumstances.

The Impact of Early Retirement on Total Lifetime Benefits

Claiming benefits early means you’ll receive lower monthly payments for life, which can add up to a significant reduction in total benefits. You might also shorten your retirement period, potentially impacting your overall financial security. Understanding these trade-offs helps you decide if early retirement aligns with your long-term goals. Additionally, considering Gold IRA Rollovers as part of your retirement strategy can provide diversification and a hedge against inflation, helping to secure your financial future.

Reduced Monthly Payouts

When you claim Social Security benefits early, you receive a smaller monthly payout, which can considerably impact your total lifetime benefits. This reduction means your monthly check might be around 30% less than if you waited until full retirement age. Over time, this can add up, especially if you live longer than expected. Consider these effects:

- Your monthly income decreases permanently, reducing your financial flexibility.

- Early claim reduces the compounding growth you’d gain from delayed benefits.

- If you retire early, the lower payout can limit your ability to cover expenses.

- You might miss out on increased benefits from delaying, which can protect against inflation.

- Properly planning your retirement savings plan can help mitigate some of these impacts by providing supplementary income.

Choosing to claim early involves balancing immediate needs against long-term financial stability. Your decision should reflect your health, finances, and retirement plans.

Shortened Retirement Duration

Early retirement can markedly shorten your overall time in the workforce, which directly impacts your total lifetime benefits. When you retire early, you start claiming Social Security benefits sooner, but your benefits are permanently reduced. This means you receive smaller monthly payments for a longer period, often resulting in lower total lifetime benefits. If you retire at 62, you might receive 70% of the full benefit, but you’ll need to live longer to break even. Conversely, delaying retirement to 70 increases your monthly payments, potentially boosting your lifetime benefits if you live a long life. However, retiring early shortens your earning years and your ability to save, which can limit future growth and financial stability. Balancing your health, finances, and longevity is key to optimizing your total benefits. Additionally, financial planning can help determine the best retirement age based on individual circumstances and health outlooks.

How Health and Longevity Influence Your Claiming Strategy

Your health and expected longevity are crucial factors in shaping your Social Security claiming strategy. If you’re healthy and anticipate a longer life, delaying benefits until 70 can maximize your monthly income and overall payout. Conversely, if health concerns or a shorter life expectancy exist, claiming earlier might be more practical. Consider these points:

Your health and longevity influence whether to delay or claim Social Security benefits early.

- Longer Life Expectancy: Delay claiming to increase monthly benefits and secure future income.

- Health Issues: Claim earlier to access benefits before potential health declines.

- Family History: If longevity runs in your family, delaying could be advantageous.

- Medical Costs: Anticipated higher healthcare expenses might prompt early claiming for added financial support.

Your health and longevity help determine whether waiting or claiming early aligns best with your financial goals.

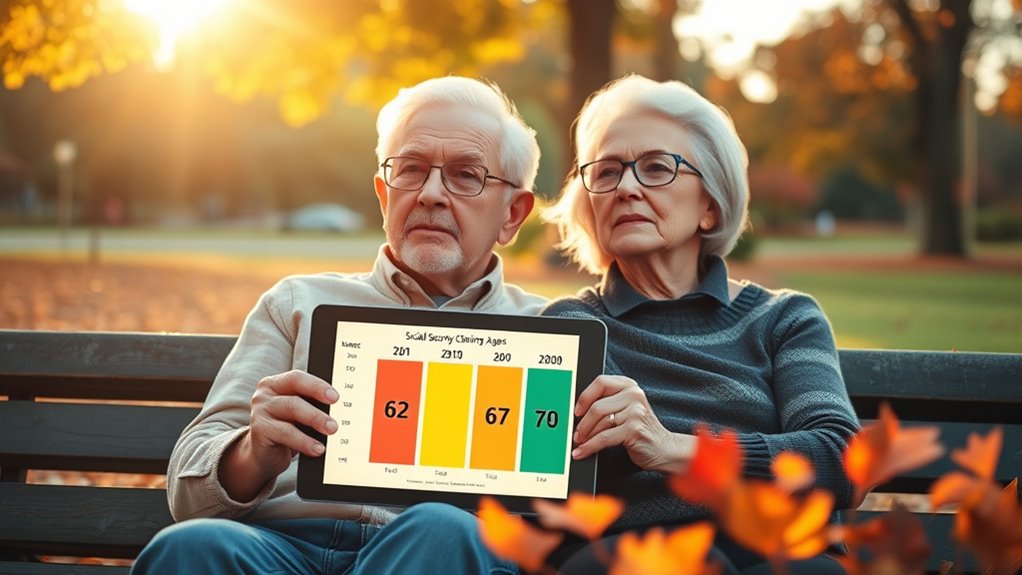

Comparing the Risks and Rewards of Different Claiming Ages

Choosing the right age to claim Social Security involves weighing the potential benefits against the risks. Claiming early at 62 offers immediate income but reduces monthly benefits by about 30%, possibly lowering lifetime total. Waiting until 67 or 70 increases monthly payments and lifetime benefits but delays income. Here’s a quick comparison:

| Age | Monthly Benefit | Key Risk/Reward |

|---|---|---|

| 62 | Lower, immediate | Risk of lower lifetime total |

| 67 | Full, standard | Balanced approach, no reduction |

| 70 | Higher, delayed | Maximize lifetime income |

Your decision hinges on health, longevity, financial needs, and risk tolerance. Weigh these factors carefully to align with your retirement goals.

The Role of Spousal Benefits in Your Decision-Making Process

Spousal benefits can considerably influence your decision on when to claim Social Security, adding a layer of complexity to retirement planning. If your spouse has a higher benefit, you might delay claiming your own to maximize their survivor benefit later. Conversely, claiming early could provide immediate income if your spouse’s benefits are lower or unavailable. Keep in mind:

Maximize household income by timing spousal benefits and survivor benefits wisely.

- You may qualify for up to 50% of your spouse’s benefit at your full retirement age.

- Claiming early can reduce your spousal benefit permanently.

- If your spouse passes away, you might receive survivor benefits based on their record.

- Coordinating your claiming age with your spouse’s benefits can optimize total household income.

- Understanding the role of AI in social media can help you better plan for digital privacy and security in your retirement years.

Understanding these dynamics helps you make smarter decisions and ensures your combined benefits support your retirement goals.

Strategies for Balancing Immediate Needs and Future Security

Balancing immediate financial needs with long-term security requires careful planning and strategic decision-making. You need to assess your current financial situation, including savings, income, and expenses, to determine if claiming benefits early is necessary. If you face urgent expenses or health issues, claiming at 62 might provide essential income, even with a permanent reduction. Conversely, if you can afford to wait, delaying benefits until 67 or 70 can substantially increase your monthly payout, boosting your future security. Consider your health, life expectancy, and other income sources when making the choice. Additionally, understanding how automation and AI technologies are transforming fields like education and business can help inform your financial planning strategies. Striking the right balance involves weighing your immediate cash flow needs against the potential benefits of higher payments later. This strategic approach helps secure both your present and future financial stability.

Practical Tips for Planning Your Social Security Retirement Benefits

Effective planning for your Social Security benefits starts with understanding your retirement goals and financial needs. Knowing when to claim depends on balancing your health, finances, and desired lifestyle. To help make informed decisions, consider these practical tips:

- Assess your health and longevity expectations to determine if delaying benefits could pay off.

- Calculate your current expenses and see if early benefits are necessary for immediate needs.

- Review spousal and survivor benefits to maximize household income.

- Create a detailed retirement plan that aligns Social Security with other income sources and savings.

- Additionally, incorporating mindful decluttering strategies can help you organize your financial documents and retirement planning materials more effectively.

Frequently Asked Questions

How Does Claiming Early Affect My Spousal or Survivor Benefits?

Claiming early can lower your spousal or survivor benefits, especially if you’re the primary earner. If you claim benefits before your full retirement age, your spouse’s benefits or survivor benefits might be reduced or delayed. However, if you delay claiming, your spouse or survivor can receive higher benefits based on your increased retirement benefit, maximizing their monthly payout. Carefully plan to guarantee you and your spouse benefit from the best timing.

What Role Does My Health Status Play in Choosing When to Claim?

Your health status plays a vital role in deciding when to claim Social Security. If you’re in poor health or have a shorter life expectancy, claiming early might make sense to access benefits sooner. Conversely, if you’re healthy and expect to live longer, delaying can maximize your monthly payout. Consider your medical outlook carefully, as it impacts your financial security and the overall benefits you’ll receive over your lifetime.

How Do Different Claiming Ages Impact My Overall Lifetime Financial Security?

Claiming at different ages impacts your lifetime financial security considerably. Claiming early at 62 reduces your monthly benefits but may provide immediate cash flow, which helps if you need income sooner. Waiting until 70 boosts your monthly payments, potentially increasing your total lifetime benefits if you live longer. Your health, longevity, and financial needs influence whether claiming early, at full retirement age, or delaying benefits offers the best long-term security.

Can I Change My Claiming Decision After I Start Receiving Benefits?

Can you change your claiming decision after you start receiving benefits? Yes, you can, but only if you’re under full retirement age and you haven’t filed for benefits yet. You can withdraw your application and reapply later, but this usually requires repaying the benefits already received. Are you prepared for potential penalties or restrictions? Carefully consider your options, as changing benefits can impact your long-term financial security.

How Do Economic Conditions Influence the Optimal Age to Claim Social Security?

Economic conditions heavily influence when you should claim Social Security. During economic downturns, claiming early can provide needed income if your financial situation worsens. Conversely, if the economy is strong and you expect a stable or growing market, delaying benefits might maximize your lifetime payout. Uncertainty or inflation risks can also prompt you to claim sooner, ensuring a steady income stream regardless of economic fluctuations.

Conclusion

Ultimately, choosing when to claim your Social Security benefits is a personal decision that balances your current needs with future security. Whether you opt for early benefits at 62 or delay until 70, remember that your choice shapes your financial journey—much like steering through the shifting tides of a bygone era. Weigh the risks and rewards carefully, and craft a strategy that aligns with your unique circumstances to enjoy peace of mind in your retirement years.